The word “budget” can be intimidating for many people, but this is the most crucial step in building wealth. Even the most wealthy company in the world has a budget, so why shouldn’t you? A budget gives your money meaning and purpose. We want to be wise when deciding how to spend our money because we trade the most valuable asset of our life to make it, which is our time.

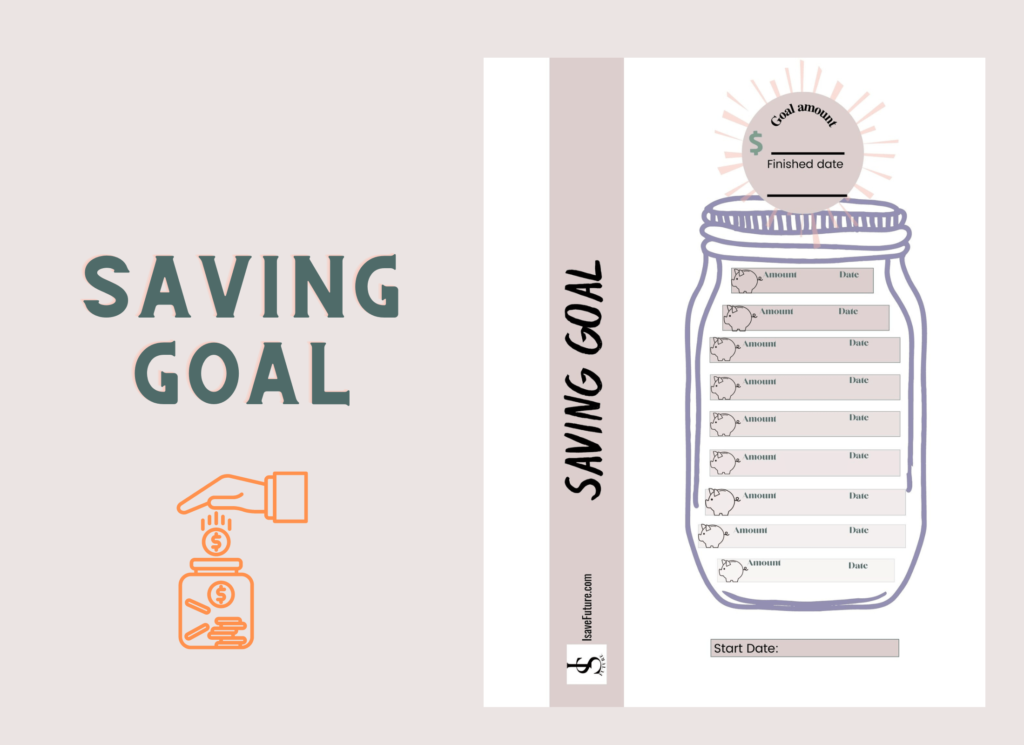

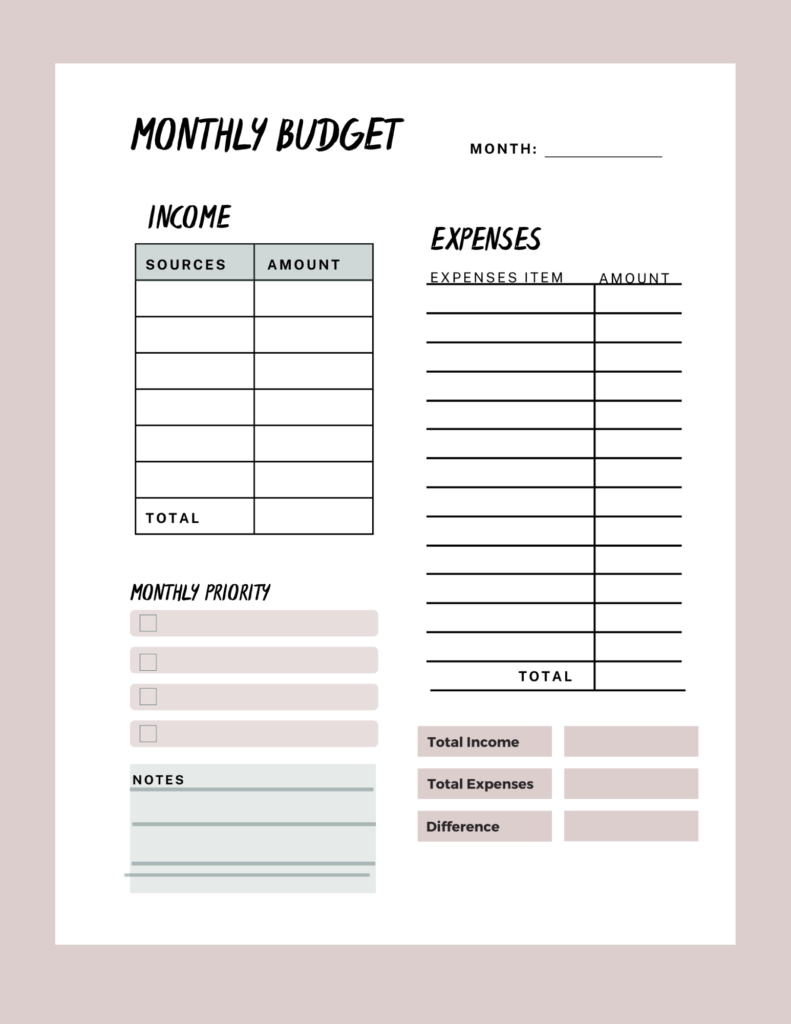

If it’s your first time creating a budget, you might notice that you’re spending more than you earn, but that’s okay for now. The main goal of having a budget is to become more mindful of our spending habits, allowing us to make necessary changes in order to align with our financial goals. Feel free to utilize the budget template we have provided. However, if you need a more personalized and detailed version, Amazon offers a great option.

Before you start creating your budget, write down your long-term financial goals. For example, maybe your goal is to retire early or buy a house in five years. Your goals will motivate you to be persistent with your budget. Your goal should include a deadline and a well-detailed action plan. Creating a comprehensive plan outlining all the necessary steps is essential to achieve your objective. Remember, a goal without a plan is just a wish, so don’t skip this step. Also, have your goals and action plans in an area you can see daily. This will keep you motivated throughout this journey. Remember, this is all about maintaining the correct mindset.

How do I start a budget?

The first step when creating a budget is writing down your income and expenses. This will give you a clear picture of how much money is coming in and how much is going out.

- Write your income

- Write all your monthly expenses.

- Subtract the expenses from your income.

Divide your budget into four major categories. Avoid itemizing everything single transaction. The idea is to simplify your budget so you don’t give up on it. The four major categories are

- Needs: This Includes housing, food, transportation, and clothes.

- Savings: This includes emergency fund savings, investments, and gifts.

- Wants: These are the things you want, but they aren’t necessary, like home decor or furniture.

- Pleasure: These are experiences like vacations or any other thing that gives you pleasure.

Now, list all your expenses under each category. For expenses that happen every certain period, divide the cost of that expense by the number of months and allocate that amount every month.

For example, an oil change usually occurs every three months. In this case, if the cost to change the oil is $60, you will divide 60 by 3 (number of months), giving you a total of $20, which is the amount you will allocate in your budget.

After completing your budget, you will know where your money is going. Now, you can make reasonable changes in areas you think you are overspending. If you are spending more than you earn, you should try to reduce your expenses or increase your income.

Get rid of your debts.

A great way to boost your income is by paying off your debts, as it allows you to retain more of your money. The “snowball method” is a great way to eliminate your debts. This method works by listing all your debts from smaller to larger. Then attack the smaller debt aggressively while paying the minimum on the other debts. When you finish paying the smaller debt, take the money you are putting toward that payment and roll it onto the next-smallest debt you own. You will continue to do this until all accounts have been paid off.

You can use this free template to track your debts.

Save for an emergency fund.

As you build margin in your budget, save for an emergency fund. This is crucial in your wealth-building journey. An emergency fund can be a lifesaver in unexpected financial challenges. By setting aside funds specifically for emergencies, you can avoid going into debt and have peace of mind knowing that you have a safety net in place. Rather than borrowing money to address the issue, you can dip into your emergency fund to cover unexpected expenses.

Aim to have at least six months of an emergency fund. The way to calculate that number is by multiplying your total monthly expenses by six. For example, if you spend $2000 every month, you will multiply 2000 by 6, and the total (12,000) is what you need to save.

Set money aside to Invest.

Once your emergency fund is in place, include investment money in your budget. This should be a priority because investing is the most critical aspect of wealth building. Financial experts recommend investing at least fifteen percent of your income.

Now, ask yourself this question, does your budget match the goals you wrote down in the first step? Your budget should lead you toward your goals and be realistic. For example, if you aim to reach financial freedom at age 45 but only invest 5% of your income, this is probably not a realistic budget. Be as realistic as possible in your written plan, and be persistent.

Build wealth

Monitoring your spending, saving, and investing is an excellent start in your wealth-building journey. The power is in your hand to change your life and family legacy. Don’t forget to write down your goals and align them with your budget.